News

Credit Card Debt and General Debt Are Rising

Many Americans have been hit hard with debt and have turned to credit cards to bridge the gaps. However, now their debts are rising as their credit card payments become overwhelming.

If your credit card debt or other debt is causing financial issues for you, contact us today! Boleman Law Firm will help you!

+ Read more

The Buy Now, Pay Later Holiday Debt Hangover Has Arrived, as Consumers Wonder How They’ll Pay Bills

Many Americans who turned to buy now, pay later payment plans to fund last year’s holiday shopping and avoid credit card debt are now having trouble paying off those bills.

If buy now, pay later, payments are causing financial issues for you, contact us today! Boleman Law Firm will help you!

+ Read more

Credit Card Delinquencies Surged in 2023, Indicating ‘Financial Stress,’ New York Fed Says

Credit card delinquencies surged more than 50% in 2023 as total consumer debt swelled to $17.5 trillion, the New York Federal Reserve reported on February 6th, 2024.

Debt that has transitioned into “serious delinquency,” or 90 days or more past due, increased across multiple categories during the year, but none more so than credit cards.

Are you struggling with credit card debt? Call Boleman Law Firm, we will help you!

+ Read more

Credit Card Debt Hits a ‘Staggering’ $1.13 Trillion

Americans now owe a collective $1.13 trillion on their credit cards, according to a new report on household debt from the Federal Reserve Bank of New York. Are you struggling with credit card debt? Call Boleman Law Firm, we will help you!

+ Read more

New York Federal Reserve Report Shows Increase in Household Debt and Delinquencies

The New York Federal Reserve reported in its latest quarterly Household Debt and Credit Report that total household debt climbed by $212 billion in the fourth quarter of 2023 to $17.5 trillion. Amid the rise in debt, delinquency rates and the transition into troubled status were both higher.

The New York Fed noted that ‘serious credit card delinquencies increased across all age groups, notably with younger borrowers surpassing pre-pandemic levels.

Are you worried about your credit card debt? Call Boleman Law Firm, we will help you!

+ Read more

Boleman Law Firm and Consumer Litigation Associates Announce Strategic Partnership to Provide Comprehensive Protection of Consumer Rights for Virginians

Boleman Law Firm, P.C., Virginia’s largest consumer bankruptcy law firm and Consumer Litigation Associates, P.C. (CLA), a nationally recognized leader in consumer advocacy based in Virginia, announced today a strategic partnership to improve the protection of consumer rights for Virginians who are going through or have gone through bankruptcy.

+ Read more

Amanda DeBerry Koehn to speak at the annual National Association of Chapter 13 Trustees Conference

Boleman Law Firm shareholder Amanda DeBerry Koehn will be speaking at the annual National Association of Chapter 13 Trustees conference in Austin, Texas. Her panels will address mortgage issues and changes to income and assets in Chapter 13 cases.

+ Read more

Foreclosure Rates on the Rise

As foreclosure rates rise, many are feeling the pressure. If you are behind on your mortgage, you don’t need to be afraid of losing your home. Boleman will help you!

+ Read more

Consumer Debt at All-Time High

Consumer debts, as well as interest rates, continue to rise. Are you feeling the pinch of increasing debt, as well as costs of living? Call Boleman Law Firm, we will help you!

+ Read more

Credit Card Debt is Mounting for Many

Credit card debt has hit an all-time high. Are you one of many Americans who have had trouble paying down their credit card bill?

You don’t have to continue to feel stressed, Boleman Law will help you!

+ Read more

Supreme Court to Rule on Student Loan Forgiveness

The Supreme Court is expected to rule soon on student loan forgiveness, triggering the countdown to student loan repayments restarting after years of being on pause. Are you able to begin repayments on your student loans, or is your budget too tight with other obligations?

+ Read more

Identity Thieves bypassed Experian Security to view Credit Reports

Recently, identity thieves were able to exploit a weakness in Experian’s security on their website. This oversight allowed identity thieves to access an unknown amount of credit reports for consumers.

+ Read more

Recent Changes to Student Loans in Bankruptcy

News has swirled recently regarding student loans, from extensions on the payment pause, to possible routes to erase part or all of an individual’s student loan obligations.

+ Read more

Don’t give Money or Information to Scammers promising Student Loan Forgiveness

Everyone should be aware of potential student loan scams. There are predatory companies and individuals seeking to capitalize on confusion over student loan repayment and forgiveness statuses. Always contact your lender directly and avoid providing personal information to unknown callers.

+ Read more

Inflation has Americans turning to Loans

Millions of folks are finding themselves stretched thin trying to pay their regular living expenses and meet their minimum monthly loan and credit card bills.

+ Read more

Matt Hahne talks about how Bankruptcy can relieve Financial Stress on 3WTKR Coast Live

Recently, Boleman Law’s Matt Hahne appeared on 3WKTR’s Coast Live segment to talk about how bankruptcy can relieve financial stress.

+ Read more

End of State Relief Program could start Eviction Crisis

As state relief programs expire and landlords are starting eviction processes, please be aware of your rights and options as a renter. You may have the option to pay back your rent arrears through a bankruptcy case and enable you to stay in your home.

+ Read more

Kathryn Shaw talks about COVID19 Mortgage Forbearance ending on 3WTKR Coast Live

Recently, Boleman Law’s Kathryn Shaw appeared on 3WKTR’s Coast Live segment to talk about various options available to homeowners who are struggling to pay their mortgage as COVID19 forbearance restrictions end.

+ Read more

Rising prices cause more Debt among Families

Consumers are paying more for everything, including the essentials, across the US. As prices rise and the median income falls, families will be greatly affected by mounting debt.

If you feel like you are drowning in debt, or your bills are piling up, you are not alone. Boleman Law will help you. We have legal solutions for your financial problems.

+ Read more

Matt Hahne talks about Debt and Bankruptcy on 3WTKR Coast Live

Boleman Law attorney Matt Hahne recently appeared on 3WTKR Coast Live to talk about debt collections, garnishments and bankruptcy.

+ Read more

COVID-19 Restrictions are Ending Soon

With the increase in vaccinations and the reduction of new cases of COVID-19 in Virginia and across the country, many of the existing COVID-related restrictions are now set to expire soon. These include various financial protections that are ending without any plans for renewal.

+ Read more

Matt Hahne talks about the Foreclosure Moratorium on 3WTKR Coast Live

Recently, Boleman Law’s Matt Hahne appeared on 3WKTR’s Coast Live segment to talk about the importance of understanding the foreclosure moratorium and its expiration date.

+ Read more

DeBerry Koehn recognized by Super Lawyers as Rising Stars of 2021

Boleman Law is proud to announce that Super Lawyers has recognized one of our excellent young lawyers within their 2021-2022 Rising Stars list.

+ Read more

Boleman Law offers Eviction Resources

Boleman Law is aware of the challenging times many find themselves in due to COVID-19 and unemployment rates. As eviction memorandums across the country expire, many may find themselves in the process of losing their residence.

+ Read more

2021 Best Lawyers Ones To Watch

Boleman Law Firm is proud to announce that Amanda DeBerry Koehn has been named Best Lawyers Ones To Watch by Best Lawyers in America.

+ Read more

Eviction hearings will resume soon

On June 22nd, the Virginia Supreme Court declined to renew an emergency order that suspended eviction proceedings in the Commonwealth. Per the Supreme Court decision, Virginia courts may resume eviction hearings related to failure to pay rent on Monday, June 29th. Governor Ralph Northam has announced that the state will roll out a rent relief program however no details have been announced and advocates fear emergency aid will arrive too little, too late.

+ Read more

Matt Hahne talks about financial options for individuals affected by COVID19 on Coast Live

Recently, Boleman Law attorney, Matt Hahne appeared on Coast Live to talk about the options people have when it comes to financial issues and the reopening of the economy after COVID19 closures. Banks will resume starting foreclosures and repossession of vehicles.

+ Read more

DeBerry Koehn recognized by Super Lawyers as Rising Stars

Boleman Law is proud to announce the recognition of one, excellent young lawyers by Superlawyers. Amanda DeBerry Koehn was named 2020-2021 Rising Stars.

+ Read more

Matt Hahne appears on Hampton Roads Show to talk about Financial Health

In April, Boleman Law attorney, Matt Hahne appeared on the Hampton Roads Show to talk about financial health during a crisis. During his appearance, Matt Hahne highlighted the two trillion dollars economic stimulus package released by the U.S. federal government.

+ Read more

Matt Hahne talks about Options for People struggling with Debt during COVID-19

Boleman Law attorney Matt Hahne spoke to 13News Now Connect about the financial strain COVID-19 has put on people’s lives and how creditor’s collection efforts have not stopped. Hahne advises calling a bankruptcy attorney right away before liquidating any assets or getting into more debt to counteract creditors.

+ Read more

Kathryne Shaw Discussing 4th Circuit Court’s Hurlburt Decision Allowing for Bifurcation of Short-Term Mortgages

What does the March 2019 decision from the Fourth Circuit Court of Appeals in Hulburt v. Black mean for you? How does it affect your Chapter 13 bankruptcy? Find out what Kathryne Shaw has to say!

+ Read more

Matt Hahne discusses the Importance of Hiring an Expert Bankruptcy Lawyer on Coast Live

Boleman attorney Matt Hahne appeared on Coast Live to discuss the dangers of filing for bankruptcy without appropriate counsel, what is called a pro se filling. Further, Hahne talks about the difference a bankruptcy lawyer makes when filing for bankruptcy and protecting you from breaking any federal laws.

+ Read more

Boleman Law Announces New Shareholder

(Richmond, VA – 09-24-2018) Boleman Law Firm, P.C. is pleased to announce that Amanda DeBerry Koehn has become the firm’s newest shareholder.

+ Read more

2019 Best Lawyers in America

We are proud to announce that Patrick T. Keith has been named again in this year’s Best Lawyers in America.

+ Read more

Virginia Military and Veteran Legal Resource Guide

What is the Virginia Military and Veteran Legal Resource Guide and how can it help you?

+ Read more

John Bollinger Discusses Concerns for Future Debt Collection with ABI

What are the concerns after the Supreme Court’s ruling in Henson v. Santander Consumer? Could it affect you? Find out what John Bollinger has to say here!

+ Read more

Matthew Hahne Talks Taxes on Coast Live

Tax season is upon us and Matthew Hahne sits down with Coast Live to talk about this stressful time. Could bankruptcy be an option?

+ Read more

Tidewater Bankruptcy Bar Association Announcements

Boleman Law Firm, P.C., is proud to announce a Tidewater Bankruptcy Bar Association election.

+ Read more

2017 Young Lawyer of the Year Announcement

Boleman Law Firm, P.C., is proud to announce Amanda DeBerry Koehn has been selected as the 2017 Young Lawyer of the Year by the Richmond Bar Association.

+ Read more

Association Announcements

Boleman Law Firm, P.C., is proud to announce a number of association elections.

+ Read more

Hahne named to GLSA Board

Matt Hahne has been elected a Director of Group Legal Services Association (GLSA) a nonprofit, ABA-affiliated organization, located in Chicago, Illinois.

+ Read more

Negative impact from housing crash shifts to “interest only” home equity lines of credit

Homeowners who signed up for “interest only” lines of credit 10 to 15 years ago are starting to default as the principal payments kick in. Underwater mortgages are of particular concern to lenders.

+ Read more

Second mortgage stripping still allowed in Chapter 13 bankruptcy

Supreme Court ruling still allows stripping underwater second mortgage in Chapter 13 bankruptcy.

+ Read more

Bankruptcy & your government security clearance

Military and government personnel are concerned that filing bankruptcy may negatively impact their security clearance and their jobs — even when a superior instructs them to file. Here are some guidelines.

+ Read more

New Boleman Law website informs and communicates

Boleman Law website launch featured in Richmond Times-Dispatch.

+ Read more

Financial wellness programs boost workplace productivity.

Financial wellness programs boost productivity. Workers under financial strain are more likely to be distracted and absent from work.

+ Read more

Payday loan business coming under close scrutiny by CFPB

The Consumer Financial Protection Bureau (CFPB) is looking into payday lending and in the next 12 to 18 months may issue guidance or propose regulations for the $46 billion business. At a CFPB hearing in Richmond last week speakers for and against payday loans were heard. Read more …http://www.richmond.com/business/sponsored-content/article_c2fa4046-d884-11e4-a4fd-5b33b58a0231.html

+ Read more

Credit Reporting Agencies Make Changes

Credit reporting agencies have agreed to be more conscientious in fixing credit report errors and to wait longer before including unpaid medical bills in reports and credit scores.

+ Read more

Bank On of Virginia Beach changes financial behavior

According to Virginia Beach, over 6,000 City households are “unbanked” – they do not have a bank account.

+ Read more

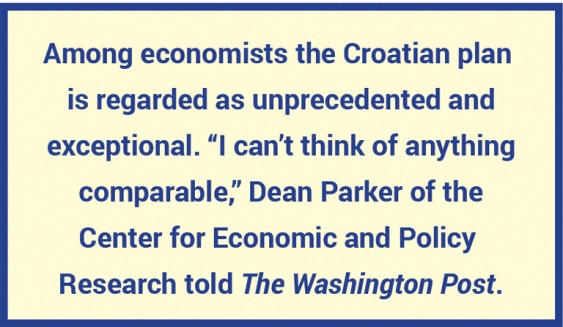

Croatia cancels the debts of 60,000 poor people.

Croatia cancels debts for 60,000 citizens. But don’t expect the same in the U.S.

+ Read more

Six Tips for choosing a bankruptcy lawyer

Choosing an experienced bankruptcy lawyer is essential to getting a fresh financial start. Here are some tips to make that first meeting more productive.

+ Read more

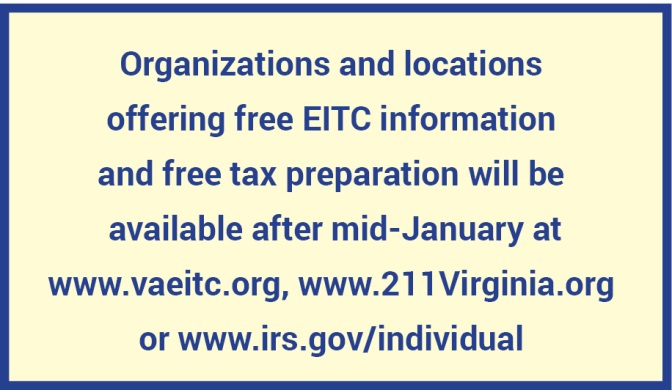

Important Tax Filing News

Free Tax Preparation & Earned Income Tax Credit (EITC) information

+ Read more

Boleman Law Firm. We will help you.

If paying for a bankruptcy has been preventing you from moving ahead, we can discuss options to make it affordable.

+ Read more

January 30th is EITC Awareness Day

Friday, January 30th is Earned Income Tax Credit Awareness Day. Virginia government, wonderful community groups and businesses across the Commonwealth have joined with the IRS in promoting the initiative.

+ Read more

Community Outreach Programs from Boleman Law Firm.

Boleman Law attorneys and professionals deliver free, entertaining, life changing personal finance management classes and seminars through a wide variety of community organizations.

+ Read more

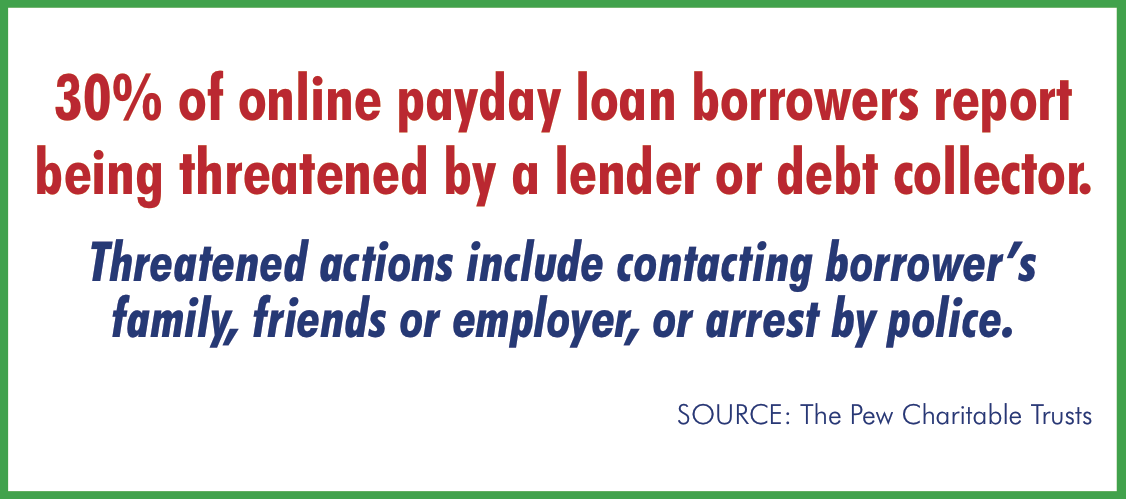

Online payday lending is a growing concern.

Our offices have been abuzz over the past couple of weeks about the recent Pew Charitable Trust report on online payday lending. Among the highlights: 650% APR is typical for lump sum online payday loans.

+ Read more

Time to get straight with the IRS.

Tax season is special. Few people enjoy it, but most somehow make the effort to file. For some the incentive is a refund. For those who have to pay, the incentive may be to prevent interest charges and fines.

+ Read more

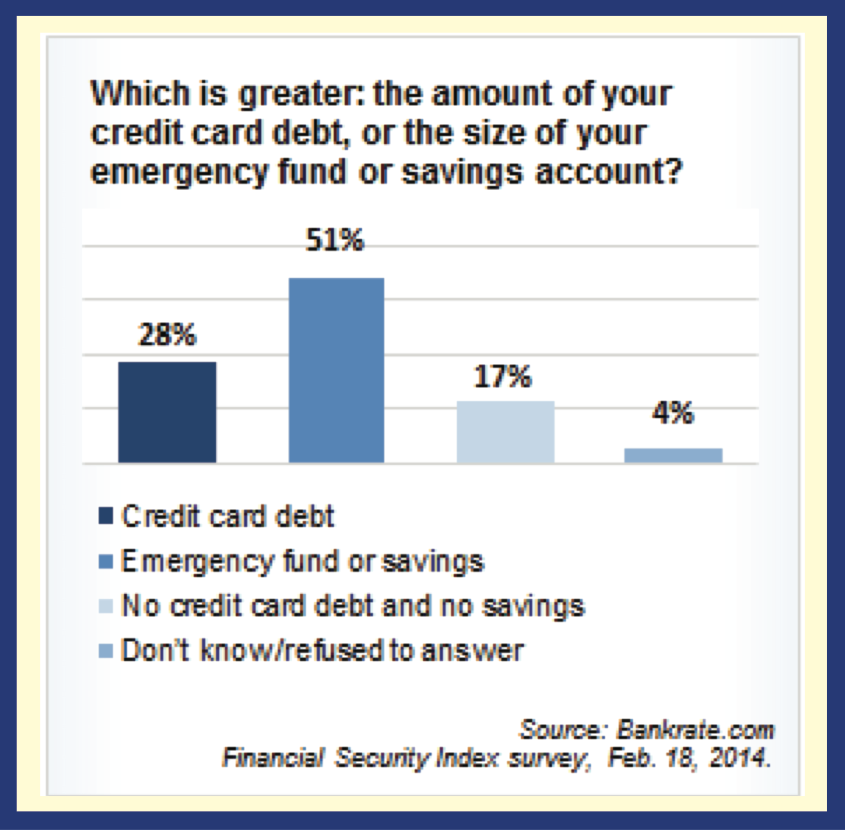

Over 25% of us aren’t ready for a financial emergency.

In America today, 28% of us have more in credit card debt than we have in savings. That’s up 5% in the past two years. Another 17% of us don’t have any credit card debt, but we don’t have any emergency savings either.

+ Read more

Money for nothing and your “checks” for free.*

It’s that time of the year again when the airwaves are humming with offers of lump sum payments on structured settlements, pennies-on-the-dollar tax payments, debt consolidation and instant cash for car titles. No credit check! Get cash with an easy payday loan.

+ Read more

Financial problems strike the rich and famous, too.

Watching all the glitz and glamor of Academy Awards recently I was struck by the thought that celebrities may be much like many Virginians. They, too, have run into overwhelming debt and filed for personal bankruptcy.

+ Read more

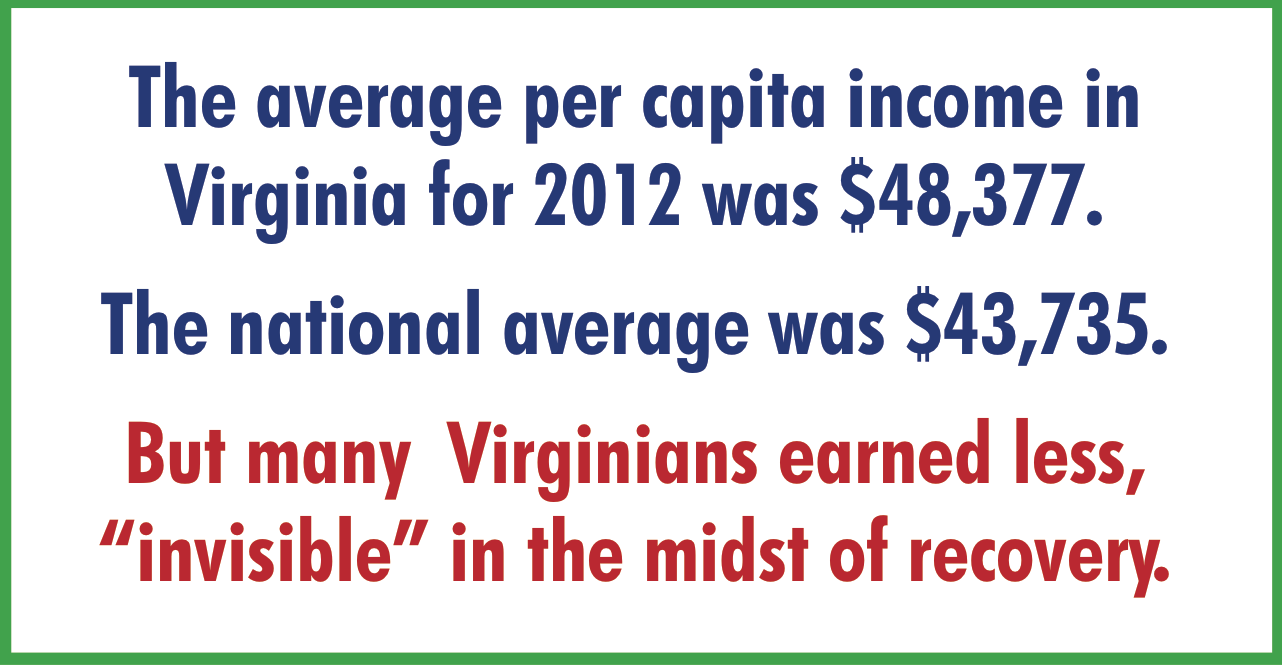

Many Virginians Still Struggling to Make Ends Meet.

The “dollar stores” are a good barometer of the economy.

The recent announcement from Family Dollar highlights the growing income gap between consumers who are regaining ground after the depression and those who are still stuck.

+ Read more

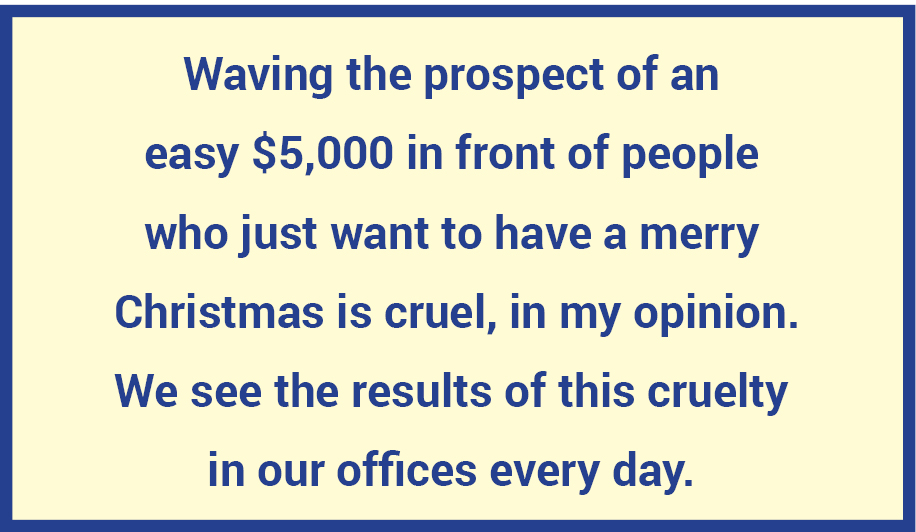

Would Santa take out a title loan against his big red sleigh?

I was watching TV a few days ago when I saw an ad that raised my blood pressure to the boiling point. It showed “Mr. and Mrs. Santa” discussing how to pay for Christmas. Mrs. Santa, in a moment of weakness, recommends taking out a title loan on their reindeer sleigh. They could get up to $5,000, she notes, without a credit check.

+ Read more

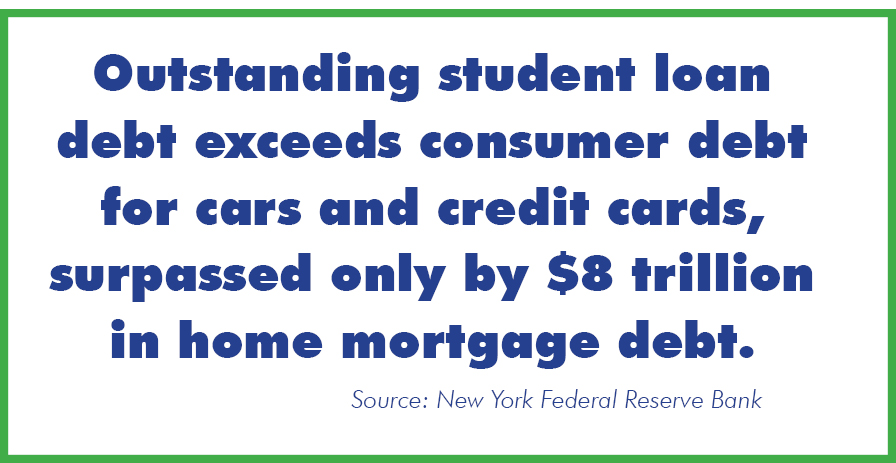

Experts differ on future impact by millennials on real estate.

“In the affordable markets the millennials are already buying in huge numbers.” So says Jonathan Smoke, chief economist at realtor.com speaking at the National Association of Realtors last week. Even with student loan debt and a below par job market, he believes that these 18 to 35-year-olds are the home buyers of the future.

+ Read more

Our wish for you this Holiday Season.

Twenty-three years ago my wife, Gayle, and I started Boleman Law Firm in a tiny Richmond office. We never dreamed of a future where Boleman Law would be the largest bankruptcy law firm in Virginia. Nor that we’d be privileged to help more than 106,000 Virginians regain their financial health.

+ Read more

Credit cards are convenient, but watch out for fees.

Apple and at least one other vendor are looking to get rid of credit cards. Wave your iPhone over the reader and funds will be instantly deducted from your account to pay for your purchase. But let’s be sensible, there will also be fees just like credit cards.

+ Read more

2015 could be the year for your fresh financial start.

For many of us, January is the time for our annual renewal. We acknowledge that 2014 is over, along with the problems and joys, and that 2015 is here, bright and shiny. It’s time to get healthy and get a fresh start.

+ Read more

©2024 Boleman Law Firm, P.C.