Credit

Credit Card Debt and General Debt Are Rising

Many Americans have been hit hard with debt and have turned to credit cards to bridge the gaps. However, now their debts are rising as their credit card payments become overwhelming.

If your credit card debt or other debt is causing financial issues for you, contact us today! Boleman Law Firm will help you!

+ Read more

Identity Thieves bypassed Experian Security to view Credit Reports

Recently, identity thieves were able to exploit a weakness in Experian’s security on their website. This oversight allowed identity thieves to access an unknown amount of credit reports for consumers.

+ Read more

Bankruptcy Court Slams NetCredit for Violating Debtors’ Rights

Bankruptcy Court: NetCredit’s conduct “constitutes a reckless disregard of [its] statutory duties in arrogant defiance of federal law.”

In each of three separate Chapter 13 bankruptcy cases co-counseled by Boleman Law Firm, P.C., Consumer Litigation Associates, and the Law Offices of Dale W. Pittman, the Bankruptcy Court ordered NetCredit to pay $100,000 in punitive damages for egregious violations of the automatic stay. Each $100,000 award included payment of $37,500.00 to National Consumer Law Center (NCLC) and $37,500.00 to Legal Services Corporation of Virginia.

+ Read more

John Bollinger Discusses Concerns for Future Debt Collection with ABI

What are the concerns after the Supreme Court’s ruling in Henson v. Santander Consumer? Could it affect you? Find out what John Bollinger has to say here!

+ Read more

Payday loan business coming under close scrutiny by CFPB

The Consumer Financial Protection Bureau (CFPB) is looking into payday lending and in the next 12 to 18 months may issue guidance or propose regulations for the $46 billion business. At a CFPB hearing in Richmond last week speakers for and against payday loans were heard. Read more …http://www.richmond.com/business/sponsored-content/article_c2fa4046-d884-11e4-a4fd-5b33b58a0231.html

+ Read more

Credit Reporting Agencies Make Changes

Credit reporting agencies have agreed to be more conscientious in fixing credit report errors and to wait longer before including unpaid medical bills in reports and credit scores.

+ Read more

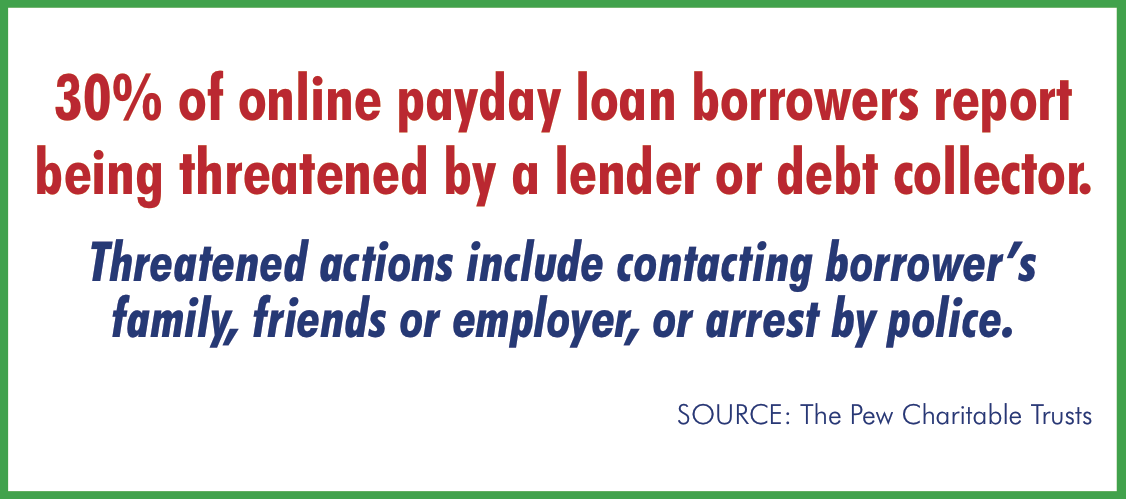

Online payday lending is a growing concern.

Our offices have been abuzz over the past couple of weeks about the recent Pew Charitable Trust report on online payday lending. Among the highlights: 650% APR is typical for lump sum online payday loans.

+ Read more

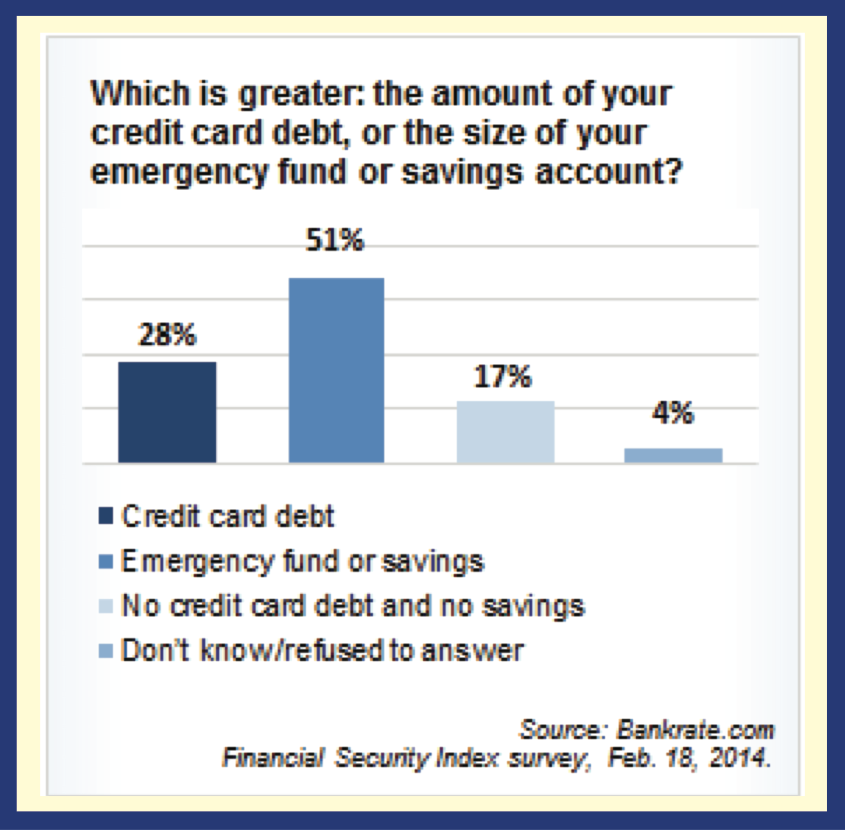

Over 25% of us aren’t ready for a financial emergency.

In America today, 28% of us have more in credit card debt than we have in savings. That’s up 5% in the past two years. Another 17% of us don’t have any credit card debt, but we don’t have any emergency savings either.

+ Read more

Would Santa take out a title loan against his big red sleigh?

I was watching TV a few days ago when I saw an ad that raised my blood pressure to the boiling point. It showed “Mr. and Mrs. Santa” discussing how to pay for Christmas. Mrs. Santa, in a moment of weakness, recommends taking out a title loan on their reindeer sleigh. They could get up to $5,000, she notes, without a credit check.

+ Read more

Credit cards are convenient, but watch out for fees.

Apple and at least one other vendor are looking to get rid of credit cards. Wave your iPhone over the reader and funds will be instantly deducted from your account to pay for your purchase. But let’s be sensible, there will also be fees just like credit cards.

+ Read more

Eliminating Debt and Avoiding Scams

Rusty Boleman speaks on Showcase Richmond about financial scams and how to avoid them when eliminating debt.

+ Read more

©2024 Boleman Law Firm, P.C.