Financial Health

Boleman Law offers Eviction Resources

Boleman Law is aware of the challenging times many find themselves in due to COVID-19 and unemployment rates. As eviction memorandums across the country expire, many may find themselves in the process of losing their residence.

+ Read more

Matt Hahne appears on Hampton Roads Show to talk about Financial Health

In April, Boleman Law attorney, Matt Hahne appeared on the Hampton Roads Show to talk about financial health during a crisis. During his appearance, Matt Hahne highlighted the two trillion dollars economic stimulus package released by the U.S. federal government.

+ Read more

Virginia Military and Veteran Legal Resource Guide

What is the Virginia Military and Veteran Legal Resource Guide and how can it help you?

+ Read more

Surprising Information About Your Credit

Credit reporting can be confusing. Quite often, what seems like “common knowledge” or “common sense” is, well, wrong. Many of the truths behind credit reporting may surprise you.

+ Read more

Credit Reporting Agencies Make Changes

Credit reporting agencies have agreed to be more conscientious in fixing credit report errors and to wait longer before including unpaid medical bills in reports and credit scores.

+ Read more

Bank On of Virginia Beach changes financial behavior

According to Virginia Beach, over 6,000 City households are “unbanked” – they do not have a bank account.

+ Read more

Get straight with the IRS now.

The IRS can pounce without warning if you haven’t filed tax returns.

+ Read more

Important Tax Filing News

Free Tax Preparation & Earned Income Tax Credit (EITC) information

+ Read more

January 30th is EITC Awareness Day

Friday, January 30th is Earned Income Tax Credit Awareness Day. Virginia government, wonderful community groups and businesses across the Commonwealth have joined with the IRS in promoting the initiative.

+ Read more

Time to get straight with the IRS.

Tax season is special. Few people enjoy it, but most somehow make the effort to file. For some the incentive is a refund. For those who have to pay, the incentive may be to prevent interest charges and fines.

+ Read more

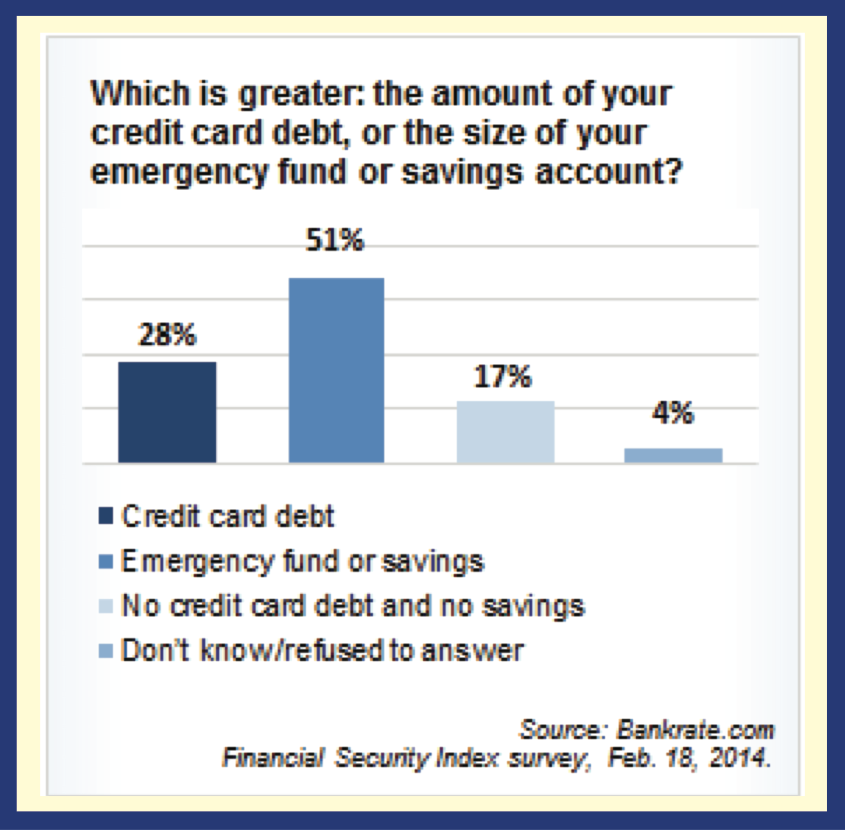

Over 25% of us aren’t ready for a financial emergency.

In America today, 28% of us have more in credit card debt than we have in savings. That’s up 5% in the past two years. Another 17% of us don’t have any credit card debt, but we don’t have any emergency savings either.

+ Read more

Financial problems strike the rich and famous, too.

Watching all the glitz and glamor of Academy Awards recently I was struck by the thought that celebrities may be much like many Virginians. They, too, have run into overwhelming debt and filed for personal bankruptcy.

+ Read more

Many Virginians Still Struggling to Make Ends Meet.

The “dollar stores” are a good barometer of the economy.

The recent announcement from Family Dollar highlights the growing income gap between consumers who are regaining ground after the depression and those who are still stuck.

+ Read more

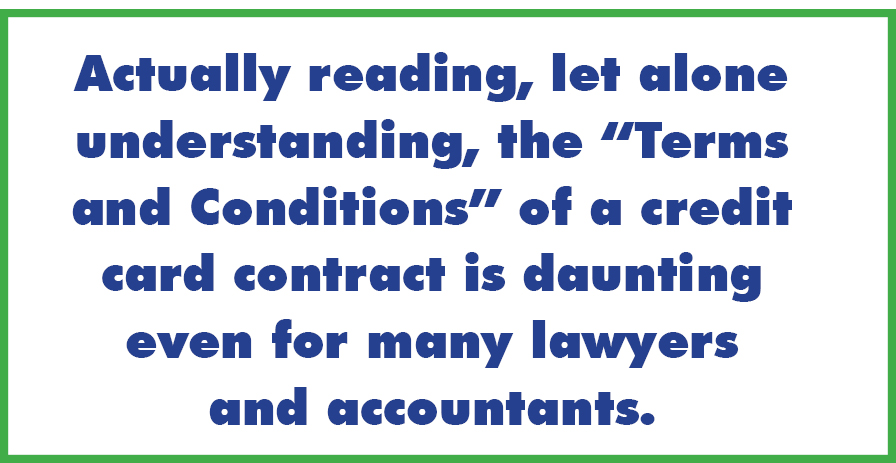

Credit cards are convenient, but watch out for fees.

Apple and at least one other vendor are looking to get rid of credit cards. Wave your iPhone over the reader and funds will be instantly deducted from your account to pay for your purchase. But let’s be sensible, there will also be fees just like credit cards.

+ Read more

2015 could be the year for your fresh financial start.

For many of us, January is the time for our annual renewal. We acknowledge that 2014 is over, along with the problems and joys, and that 2015 is here, bright and shiny. It’s time to get healthy and get a fresh start.

+ Read more

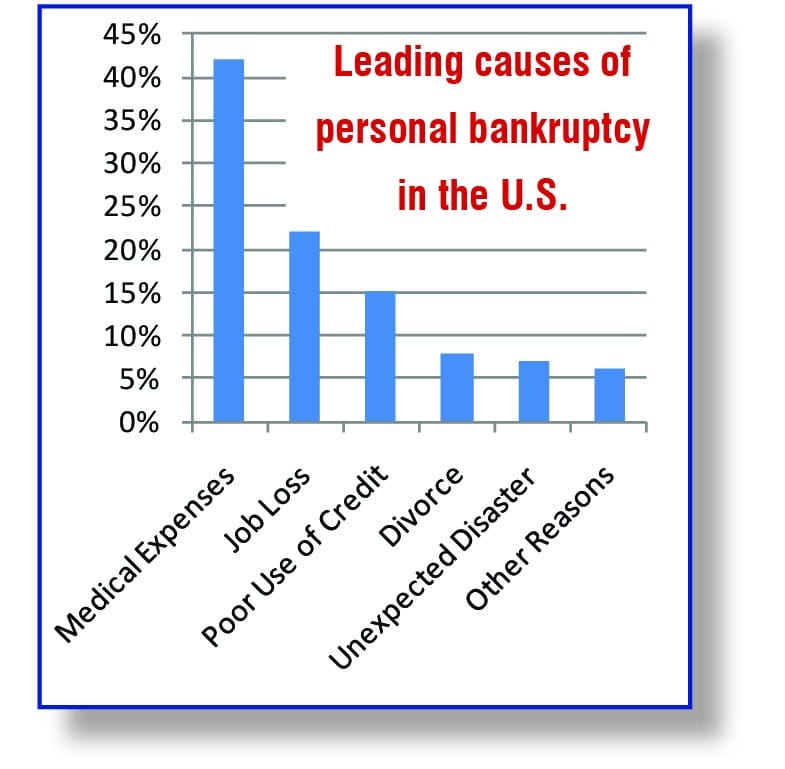

Financial problems can happen to anyone.

If you’re worried about your financial situation, don’t be embarrassed. You’re not alone. There are legal solutions. We will help you.

+ Read more

Creating a personal budget.

An important step in taking control of your personal finances is to create a realistic budget and stick to it.

+ Read more

Preparing for cutbacks, layoffs and sequestration.

If you’re like most people, you live from paycheck to paycheck. But what happens if your paycheck is suddenly cut by 20% or disappears altogether? If you see sequestration or work cutbacks in your future, here are 10 things you can do to do to get ready.

+ Read more

©2024 Boleman Law Firm, P.C.