About Debts

Consumer Debt at All-Time High

Consumer debts, as well as interest rates, continue to rise. Are you feeling the pinch of increasing debt, as well as costs of living? Call Boleman Law Firm, we will help you!

+ Read more

Credit Card Debt is Mounting for Many

Credit card debt has hit an all-time high. Are you one of many Americans who have had trouble paying down their credit card bill?

You don’t have to continue to feel stressed, Boleman Law will help you!

+ Read more

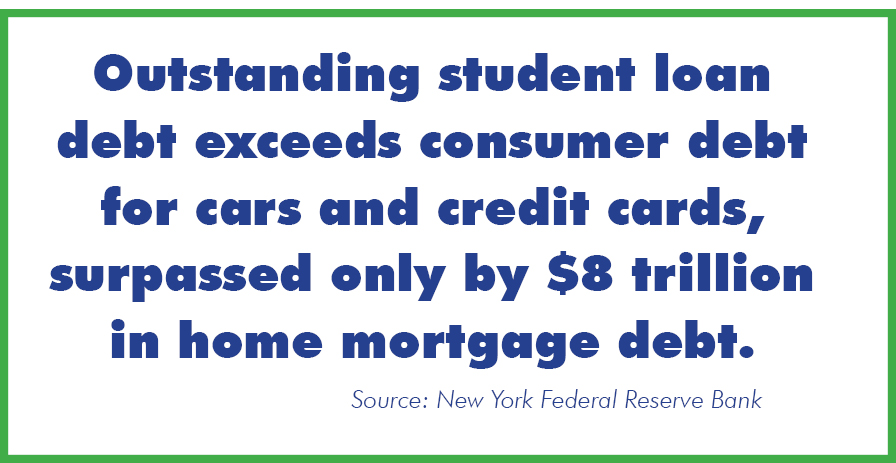

Supreme Court to Rule on Student Loan Forgiveness

The Supreme Court is expected to rule soon on student loan forgiveness, triggering the countdown to student loan repayments restarting after years of being on pause. Are you able to begin repayments on your student loans, or is your budget too tight with other obligations?

+ Read more

Boleman Law offers Eviction Resources

Boleman Law is aware of the challenging times many find themselves in due to COVID-19 and unemployment rates. As eviction memorandums across the country expire, many may find themselves in the process of losing their residence.

+ Read more

Negative impact from housing crash shifts to “interest only” home equity lines of credit

Homeowners who signed up for “interest only” lines of credit 10 to 15 years ago are starting to default as the principal payments kick in. Underwater mortgages are of particular concern to lenders.

+ Read more

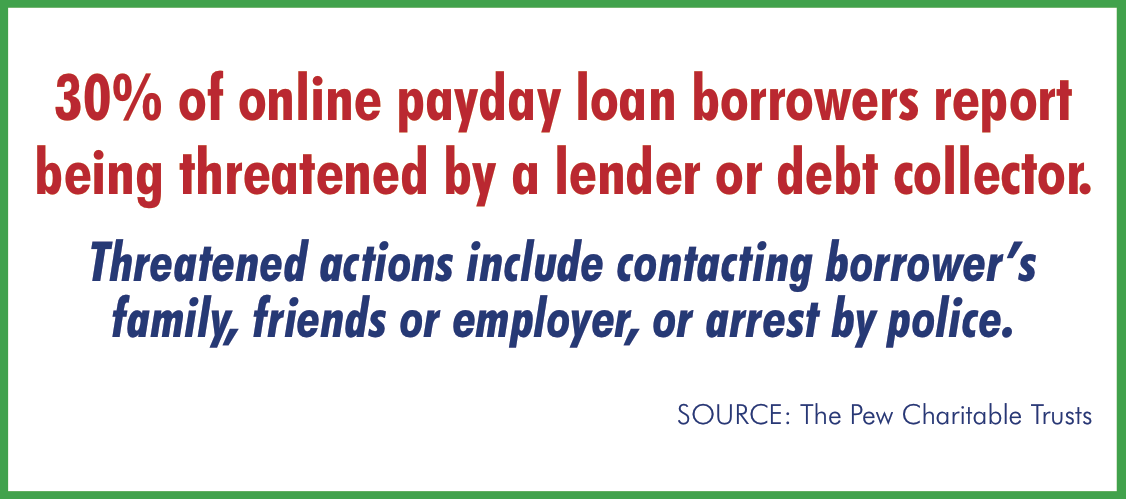

Payday loan business coming under close scrutiny by CFPB

The Consumer Financial Protection Bureau (CFPB) is looking into payday lending and in the next 12 to 18 months may issue guidance or propose regulations for the $46 billion business. At a CFPB hearing in Richmond last week speakers for and against payday loans were heard. Read more …http://www.richmond.com/business/sponsored-content/article_c2fa4046-d884-11e4-a4fd-5b33b58a0231.html

+ Read more

Croatia cancels the debts of 60,000 poor people.

Croatia cancels debts for 60,000 citizens. But don’t expect the same in the U.S.

+ Read more

Online payday lending is a growing concern.

Our offices have been abuzz over the past couple of weeks about the recent Pew Charitable Trust report on online payday lending. Among the highlights: 650% APR is typical for lump sum online payday loans.

+ Read more

Would Santa take out a title loan against his big red sleigh?

I was watching TV a few days ago when I saw an ad that raised my blood pressure to the boiling point. It showed “Mr. and Mrs. Santa” discussing how to pay for Christmas. Mrs. Santa, in a moment of weakness, recommends taking out a title loan on their reindeer sleigh. They could get up to $5,000, she notes, without a credit check.

+ Read more

Experts differ on future impact by millennials on real estate.

“In the affordable markets the millennials are already buying in huge numbers.” So says Jonathan Smoke, chief economist at realtor.com speaking at the National Association of Realtors last week. Even with student loan debt and a below par job market, he believes that these 18 to 35-year-olds are the home buyers of the future.

+ Read more

©2024 Boleman Law Firm, P.C.