Mortgage relief funds are quickly depleting, and the Virginia Mortgage Relief Fund has announced that they will no longer accept applications beginning October 1. If you are unable to get assistance, and have arrears on your mortgage, please call Boleman Law Firm. We will help you!

The Supreme Court is expected to rule soon on student loan forgiveness, triggering the countdown to student loan repayments restarting after years of being on pause. Are you able to begin repayments on your student loans, or is your budget too tight with other obligations?

News has swirled recently regarding student loans, from extensions on the payment pause, to possible routes to erase part or all of an individual’s student loan obligations.

Predicted returns to pre-pandemic collections are rapidly becoming reality. Foreclosures have spiked, as have many other forms of collection like garnishments, evictions, and repossessions. Boleman Law will help you with these financial problems.

Boleman Law Firm is proud to announce that Rusty Boleman, John Bollinger, and Patrick Keith have been named Best Lawyers in America.

On June 22nd, the Virginia Supreme Court declined to renew an emergency order that suspended eviction proceedings in the Commonwealth. Per the Supreme Court decision, Virginia courts may resume eviction hearings related to failure to pay rent on Monday, June 29th. Governor Ralph Northam has announced that the state will roll out a rent relief program however no details have been announced and advocates fear emergency aid will arrive too little, too late.

Boleman attorney Matt Hahne addresses attendees of the 2019 Group Legal Services Association Spring Conference in Tampa, FL. Matt is the President of the GLSA, which improves access to affordable legal services by creating support for its legal services plan industry members.

We are proud to announce that Patrick T. Keith has been named again in this year’s Best Lawyers in America.

Tolls in Virginia can build up and interfere with your life and threaten your vehicle.

Since 1991 Boleman Law Firm has helped over 140,000 Virginians regain their financial health. They help people with financial problems such as vehicle repossession, job loss, home foreclosures, credit card debt and payday or title loans.

Matt Hahne has been elected a Director of Group Legal Services Association (GLSA) a nonprofit, ABA-affiliated organization, located in Chicago, Illinois.

Rule 3002.1: A Case Odyssey ¹

Federal Rule of Bankruptcy Procedure 3002.1 was intended to address communication problems regarding mortgage companies and Chapter 13 debtors, and the rule furthers its goal of increased transparency in two ways.

Homeowners who signed up for “interest only” lines of credit 10 to 15 years ago are starting to default as the principal payments kick in. Underwater mortgages are of particular concern to lenders.

Boleman Law website launch featured in Richmond Times-Dispatch.

Financial wellness programs boost productivity. Workers under financial strain are more likely to be distracted and absent from work.

The Consumer Financial Protection Bureau (CFPB) is looking into payday lending and in the next 12 to 18 months may issue guidance or propose regulations for the $46 billion business. At a CFPB hearing in Richmond last week speakers for and against payday loans were heard. Read more …http://www.richmond.com/business/sponsored-content/article_c2fa4046-d884-11e4-a4fd-5b33b58a0231.html

Credit reporting agencies have agreed to be more conscientious in fixing credit report errors and to wait longer before including unpaid medical bills in reports and credit scores.

According to Virginia Beach, over 6,000 City households are “unbanked” – they do not have a bank account.

Friday, January 30th is Earned Income Tax Credit Awareness Day. Virginia government, wonderful community groups and businesses across the Commonwealth have joined with the IRS in promoting the initiative.

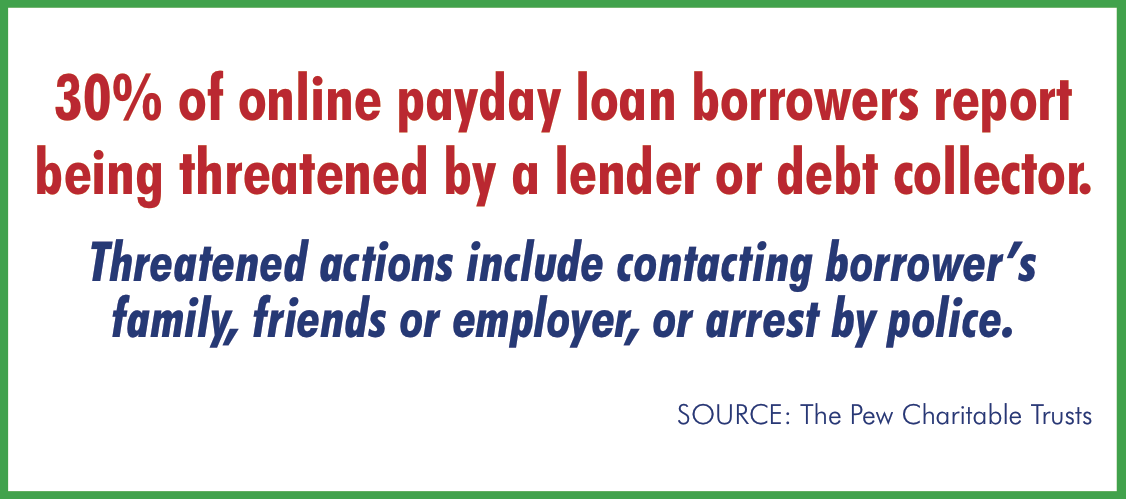

Our offices have been abuzz over the past couple of weeks about the Pew Charitable Trust report on online payday lending. Among the highlights: 650% APR is typical for lump sum online payday loans.

Tax season is special. Few people enjoy it, but most somehow make the effort to file. For some the incentive is a refund. For those who have to pay, the incentive may be to prevent interest charges and fines.

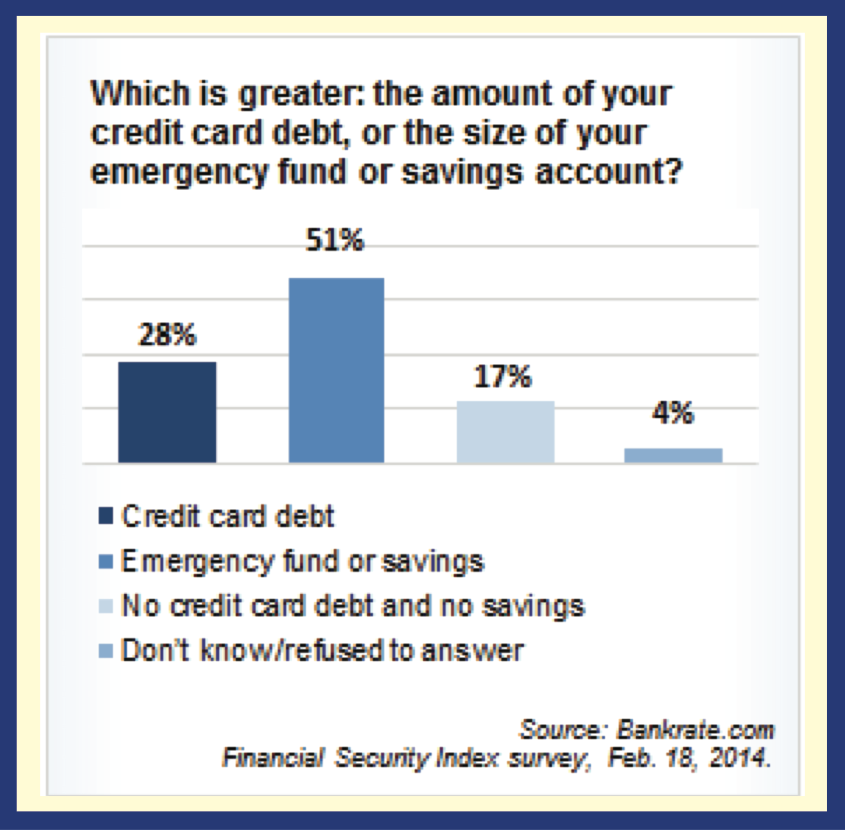

In America today, 28% of us have more in credit card debt than we have in savings. That’s up 5% in the past two years. Another 17% of us don’t have any credit card debt, but we don’t have any emergency savings either.

It’s that time of the year again when the airwaves are humming with offers of lump sum payments on structured settlements, pennies-on-the-dollar tax payments, debt consolidation and instant cash for car titles. No credit check! Get cash with an easy payday loan.

Watching all the glitz and glamor of Academy Awards recently I was struck by the thought that celebrities may be much like many Virginians. They, too, have run into overwhelming debt and filed for personal bankruptcy.

“In the affordable markets the millennials are already buying in huge numbers.” So says Jonathan Smoke, chief economist at realtor.com speaking at the National Association of Realtors last week. Even with student loan debt and a below par job market, he believes that these 18 to 35-year-olds are the home buyers of the future.

Apple and at least one other vendor are looking to get rid of credit cards. Wave your iPhone over the reader and funds will be instantly deducted from your account to pay for your purchase. But let’s be sensible, there will also be fees just like credit cards.

For many of us, January is the time for our annual renewal. We acknowledge that last year is over, along with the problems and joys, and that a new year is here, bright and shiny. It’s time to get financially healthy and get a fresh start.

Topics

Types

Topics

Types

Mortgage relief funds are quickly depleting, and the Virginia Mortgage Relief Fund has announced that they will no longer accept applications beginning October 1. If you are unable to get assistance, and have arrears on your mortgage, please call Boleman Law Firm. We will help you!

The Supreme Court is expected to rule soon on student loan forgiveness, triggering the countdown to student loan repayments restarting after years of being on pause. Are you able to begin repayments on your student loans, or is your budget too tight with other obligations?

News has swirled recently regarding student loans, from extensions on the payment pause, to possible routes to erase part or all of an individual’s student loan obligations.