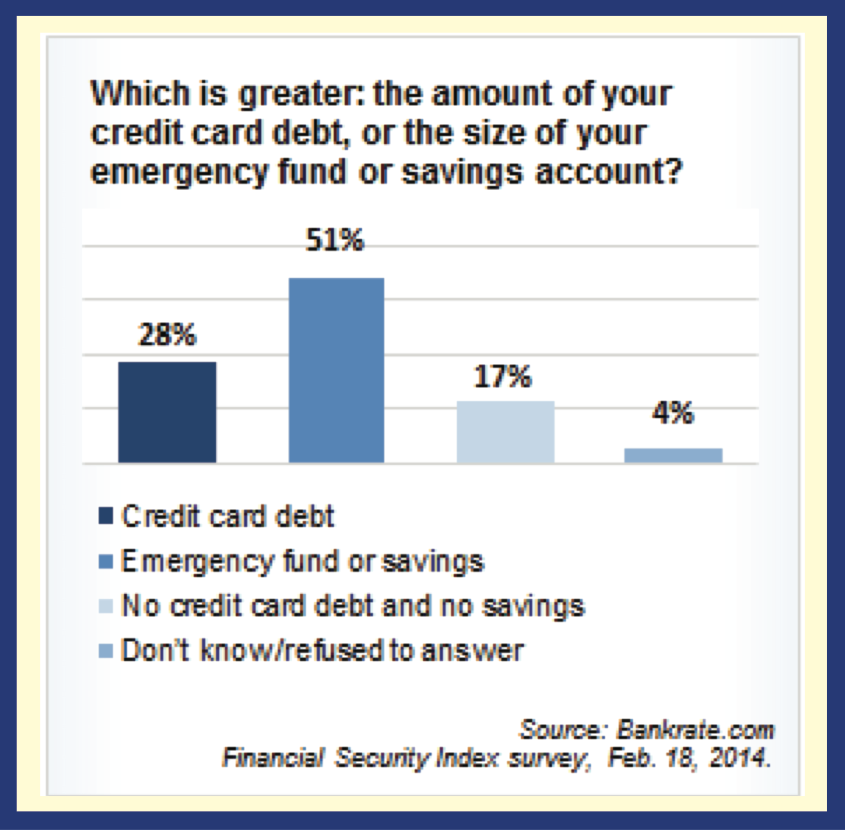

Over 25% of us aren’t ready for a financial emergency.

In America today, 28% of us have more in credit card debt than we have in savings. That’s up 5% in the past two years. Another 17% of us don’t have any credit card debt, but we don’t have any emergency savings either.

Those are among the findings of the recent Bankrate.com Financial Security Index survey. It means that one quarter of Americans probably can’t pay their credit card debt if they have a medical emergency or lose their job.

Spending is trending upward. Credit card balances rose 1.9% over the last year according to the Federal Reserve as the U.S. and world economy started to recover from the Recession.

Greg McBride, Bankrate’s chief financial analyst, notes that people in their prime earning years, between the ages of 30 and 64, are the most likely to be piling on credit card debt and neglecting their savings.

Other interesting findings:

- Being parents – 33% of parents reported higher credit card debt than savings versus 25% for non-parents. (That’s not surprising!)

- Education – 62% of college grads reported higher savings than credit card debt versus 44% for those who didn’t attend college.

These findings reveal all too clearly that people are still struggling and many are facing the prospect of overwhelming debt if and when an emergency happens. Our attorneys talk with many of them every day in our offices.

If you, or anyone you know, is in this situation, call us immediately. We offer everyone a FREE Consultation with a skilled, experienced attorney to discuss options and plan the best legal solutions.

As Virginia’s largest consumer bankruptcy law firm, we have helped over 140,000 people since 1991. Schedule your FREE Consultation today!