Online payday lending is a growing concern.

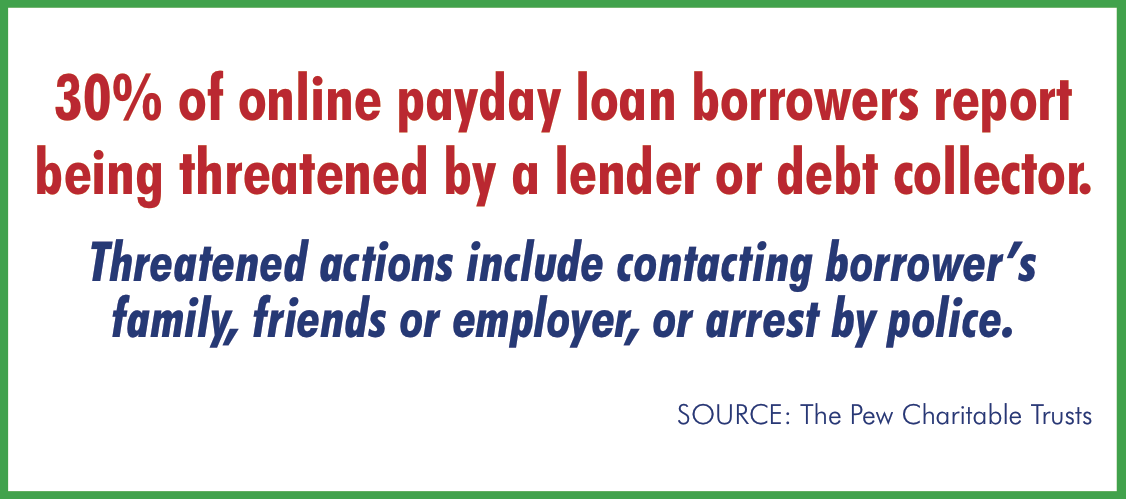

Our offices have been abuzz over the past couple of weeks about the Pew Charitable Trust report on online payday lending. Among the highlights: 650% APR is typical for lump sum online payday loans.

One-third of online loans are structured to renew automatically, paying only the interest without reducing the principal.

And 90% of payday loan complaints to the Better Business Bureau are against online lenders, although online loans (as opposed to storefront) account for only about one-third of the market.

The news of the Pew report came via our friends at the Virginia Poverty Law Center who will be holding their annual statewide legal aid conference in Portsmouth next week. Payday loans will be among the critical topics being discussed. Boleman Law is proud to be a long term VPLC conference sponsor.

Naturally this concerns us because we see so many casualties of payday loans in our offices every day. They have been caught in the ‘death spiral’ of overdrawn checking accounts from unauthorized bank withdrawals, credit reporting issues, intimidation and threats plus an overwhelming burden of debt that never seems to end.

Here are two ways you can help:

- Discourage anyone from taking out a payday loan. Encourage them to ask their family, friends or church for help instead.

- Encourage legislation to curb the abuses.

If someone you know is losing their battle with overwhelming debt, contact us for a FREE Consultation. They will get a FREE Consultation with a skilled experienced attorney to discuss options and the best legal solutions to protect their rights.