Experts differ on future impact by millennials on real estate.

“In the affordable markets the millennials are already buying in huge numbers.” So says Jonathan Smoke, chief economist at realtor.com speaking at the National Association of Realtors last week. Even with student loan debt and a below par job market, he believes that these 18 to 35-year-olds are the home buyers of the future.

Not everyone agrees. “The personal finances of millennials have become increasingly precarious… and leaves them further away from goals such as home ownership…” according to a piece in The Wall Street Journal earlier this week.

Generation X (who were under 35 in 1995) earned 9% more, after adjusting for inflation, than millennials and had a net worth of $18,200 compared to $10,400 for millennials according to government data.

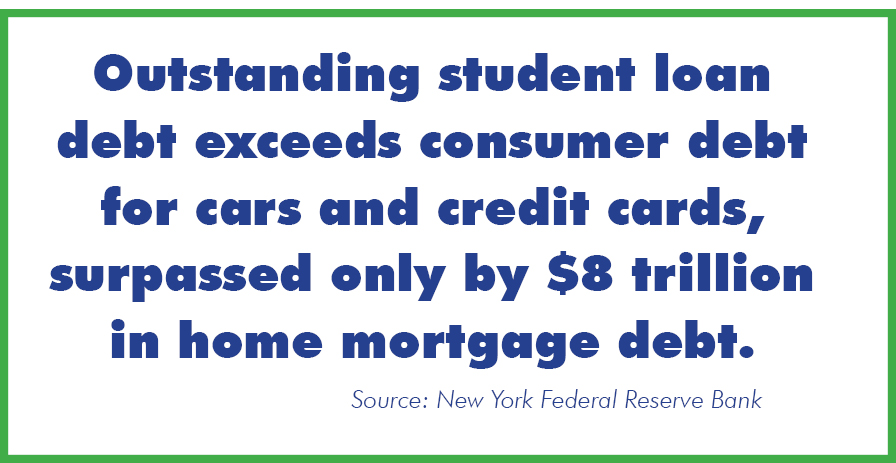

But virtually everyone agrees that the biggest financial millstone around the necks of millennials is student loan debt.

Government data reveals that Gen Xers had a median student loan debt of $6,100. Millennials are now carrying $17,200.

Smoke points out that about two-thirds of millennials have student loans, but almost half are either still in school or in a deferment or forbearance program. Many of them have been living in their parent’s basement, but the job creation market this year may be the best since 2000 and the rate of hiring for millennials is 60% better than other age groups, he notes.

In the past in this column we’ve cautioned that, because of ballooning student loan debt, we may be facing a generation of renters who will never be able to buy a home. Residential real estate sales are a good barometer of America’s economic health. Let’s hope that Mr. Smoke is correct in his assessment.

Do you need financial help? Schedule a FREE Consultation today.

This column originally appeared in the Richmond Times Dispatch on 11-14-2014.