Info Center

Financial problems can happen to anyone.

If you’re worried about your financial situation, don’t be embarrassed. You’re not alone. There are legal solutions. We will help you.

Bad things can happen to good people through no fault of their own

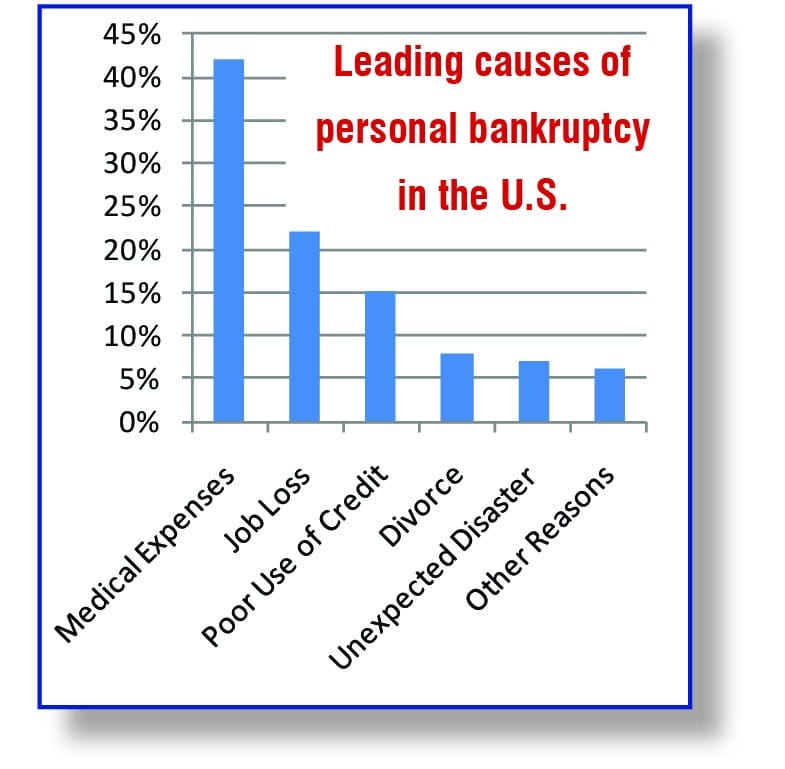

- According to a Harvard University study, 42% of personal bankruptcies in the U.S. are the result of medical expenses.

- 78% of the bankruptcy filers had some sort of medical insurance.

- Job loss accounts for 22% of personal bankruptcies.

- The loss of employer medical insurance, or paying the premium, also drains the job seeker’s funds.

- If there’s no emergency fund to fall back on, the situation can worsen.

- Using credit cards to stay afloat can be disastrous.

- Credit card bills, large mortgages and expensive car payments all contribute to 15% of bankruptcy filings.

- Statistics indicate that most debt consolidation plans fail and only delay the bankruptcy filing.

- Home equity loans may lead to foreclosure if payments fall behind.

- The other 21% of personal bankruptcies are caused by divorce, unexpected disasters (floods and hurricanes), and other causes.

- Although student loans cannot be eliminated through bankruptcy, some people may file to get relief from other debts so they can pay off the student loan.

There are legal solutions to overwhelming debt.

Bankruptcy can forgive some or all of your personal debt and help you start over. If you are worried about your financial situation, don’t feel embarrassed. You are not alone. Just get the best expert help available.

Boleman Law attorneys are specialists in personal bankruptcy. We are the largest consumer bankruptcy law firm in Virginia. We can help you keep your home, stop vehicle repossession or disablement, stop wage garnishment and harassing phone calls. Since 1991 we have helped more than 106,000 Virginians back to financial health.

Likely signs of future financial problems:

- You’re behind on your mortgage and don’t see a way to get caught up.

- You’re taken out a payday or title loan trying to catch up.

- You’re using a credit card cash advance to pay another credit card.

- You’ve missed one or more car payments.

- Bill collectors are calling you at home or at work.

- You can’t make your minimum credit card payments.

Definite signs of financial problems right now:

- You’ve received a foreclosure notice.

- Your wages have been garnished.

- Your car, furniture or appliances have been repossessed.

Bankruptcy may be the answer for you.

If you have any of these warning signs, call immediately for a FREE consultation with a skilled, experienced Boleman Law bankruptcy attorney. We will always treat you with the respect you deserve and there is no cost for the consultation.

Some people wait too long to get help. Don’t put it off. Call now.

We will help you.

Download PDF

John R. Bollinger

John Bollinger is a Shareholder at the Boleman Law Firm and is a Vice President in the firm. He is currently the Partner in Charge of the Newport News Office. He has been practicing bankruptcy law since 2000 and joined Boleman Law in 2004. He specializes in complex consumer bankruptcy issues.

John was raised in Oneonta, New York. He currently lives in Williamsburg with his wife and two daughters. John enjoys spending time with his family, fishing, and visiting the beach.

©2024 Boleman Law Firm, P.C.