Stopping harassing debt collection calls.

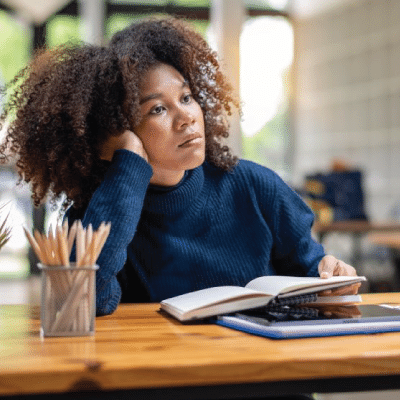

For people facing overwhelming debt, just answering the phone or opening the mail can be stressful.

The phone rings, but if it’s not on caller ID it goes unanswered. The mail piles up unopened. Life, it seems, goes on hold for some people when bill collectors start to contact them. They don’t have the money to pay so there are no answers.

Debt collectors, like humans, come in all sorts of forms. Some are quiet and mannerly. Others are loud and harassing. But they all want to know when you’re going to pay the bill. With interest and late fees and legal charges attached. Collection letters are printed on colored paper, as if that’s going to get the bill paid faster.

There are many reasons why people fall behind on their debts. Medical bills. Job loss or cutbacks at work. Divorce. Financial emergencies. People fall to the temptation of overspending on credit cards. Others take out a payday or title loan and can’t ever seem to get it paid off.

Bankruptcy will stop the harassing collection calls and letters because it ends the debt as well as starting the process of getting your credit – and your life – back.

The benefits of consumer bankruptcy:

- You get a fresh financial start. Your debts are forgiven or you can elect to pay all or an affordable part of the balance over a period of time – up to five years.

- Your credit report and credit score (which would have been damaged by the overdue debts) can start to recover and be rebuilt.

- A home foreclosure or vehicle repossession may be stopped immediately. If fact, a bankruptcy may lower your car payment significantly and may strip away a second mortgage on your home if the current value is less than the first mortgage amount.

- The harassing calls and collection letters will stop.

Boleman Law attorneys are bankruptcy specialists

If collectors are hounding you and your blood pressure jumps every time the phone rings, call for a free appointment with a skilled, experienced bankruptcy attorney at Boleman Law. There’s no cost for the consultation and no time limit. All of your questions will be clearly answered and your legal options fully explained.

The lawyers and professional staff at Boleman Law will help you through the often confusing and emotional bankruptcy process. We will complete all of the paperwork for you. We stay with you throughout the course of your bankruptcy.

Boleman Law is the largest consumer bankruptcy firm in Virginia. Since 1991 we have helped more than 140,000 Virginians regain their financial health.